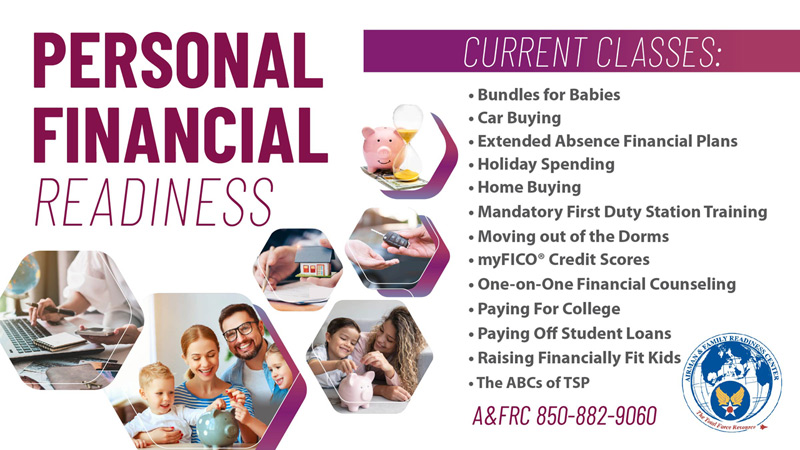

Eglin’s Military & Family Readiness Center offers a number of different classes, services, and educational opportunities for improving the personal financial readiness of Team Eglin members and families.

- Home Buying — Buying a home is one of the most significant purchases people will ever make. This course is designed to increase the knowledge of the home-buying process and the financial aspects of homeownership. This class is great for first-time homebuyers and a good refresher for repeat homebuyers.

- Holiday Spending — How to Survive the Holidays Financially is designed to help service members plan for the added expenses of holidays and special events. Develop strategies to avoid overspending and accumulating excessive debt. The money management tips in this course apply year-round to all holidays and special occasions.

- Raising Financially Fit Kids — This course is designed to help parents learn how to teach their children sound financial management skills. During the course, parents will examine their own financial skills and behaviors in an effort to determine the how to best implement age-appropriate financial practices for their children.

- Car Buying — Most service members will purchase a new or used car while in the service. This course teaches all aspects of the car buying process to include; financing, state registration, insurance, vehicle type research, and the importance of utilizing a budget so that ‘too much car’ isn’t purchased.

- Bundles for Babies — A fun-filled workshop for expectant parents from all branches of service. Expectant parents will receive valuable education on budgeting for the new baby, as well as other base programs available to families. All branches are welcome to attend. *Though the class is open to everyone, AF and Navy participants will be given an AAFES gift card sponsored by the Air Force Aid Society and the Navy/Marine Corps Relief Society.

- Paying For College — Helpful information for individuals entering college now or in the near future, as well as for parents who want to save for their children’s future education.

- Paying Off Student Loans — This class provides awareness of student loan debt management strategies to improve current financial situations, avoid student loan delinquency and default, and how to repay student loans as quickly and inexpensively as possible.

And that’s not all! Other financial classes and services available through the M&FRC include:

- One-on-One financial education by appointment

- Mandatory first duty station training for officers and enlisted personnel

- Extended absence financial plans

- Fair Isaac & Company (FICO®) credit scores

To inquire about class/appointment availability please contact the M&FRC at 850.882.060.